Business vehicle depreciation calculator

The tool includes updates to. Gas repairs oil insurance registration and of course.

Annual Depreciation Of A New Car Find The Future Value Youtube

Car Depreciation Calculator This calculator calculates the cost of depreciation for your car.

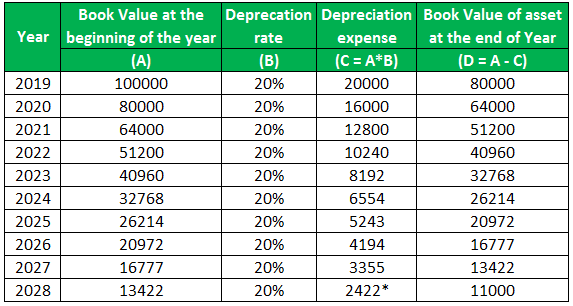

. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Assume a depreciation rate of 30 after the first year and 20 each. Im dealing with a.

510 Business Use of Car. The car depreciation calculator will reflect the cars initial value in this case over 20500 if you enter the value into the 3 years box. According to a 2019 study the average new car depreciates by nearly half of its value after five years.

SUVs with a gross vehicle weight rating above 6000 lbs. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to. Business vehicle depreciation is a complex subject but it could lead to substantial deductions for your business at tax time.

They are however limited to a 26200. Free MACRS depreciation calculator with schedules. Alternatively if you use the actual cost method you may take deductions.

Adheres to IRS Pub. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. Years 4 and 5 1152.

To use the calculator simply enter the purchase price of the car and the age at. To compute business vehicle. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle.

According to the general rule you calculate depreciation over a six-year span as follows. However different cars depreciate at different rates with SUVs and trucks generally. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Are not subject to depreciation including bonus depreciation limits. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. C is the original purchase price or basis of an asset. The MACRS Depreciation Calculator uses the following basic formula.

Before you use this tool. To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Example Calculation Using the Section 179 Calculator.

Year 1 20 of the cost. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Find out how here.

For instance a widget-making machine is said to. D i C R i. Where Di is the depreciation in year i.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Depreciation Of Vehicles Atotaxrates Info

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Rate And Idv Calculator Mintwise

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator Irs Publication 946

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Calculator

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator Depreciation Of An Asset Car Property

Car Depreciation Calculator

Macrs Depreciation Calculator Irs Publication 946

Depreciation Rate Formula Examples How To Calculate

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent